Legacy Planning Services Vancouver BC

Menu

Family Office Services

How does Lugen Family Office work with you?

We’re part of your team. We’re in your corner. Our clients trust us because we are committed to transparency, accountability, creative strategies, and total disclosure.

- We believe our clients’ projects should be respected, protected, expanded and nurtured.

- We believe every legacy project must be treated as a core business.

- We believe in serving as your advocate on agreed upon projects, while providing you with independent strategic advice which helps you achieve success.

- We believe that team members within legacy projects should be aligned based on values and behaviours so as not to impede not be decision making. Therefore, we use our proprietary collaboration model to mediate disagreements and ensure amicable solutions are decided.

- We believe that our clients should stay in control of their own legacy projects, always be engaged, and actively involved in the decision making process.

Why We Have Developed A PRIVATE Eco-System For You?

Featured Family Office Services

Legacy Projects

Project Management of Legacy Projects: Honoring the Past, Shaping the Future

Managing legacy projects demands a delicate balance of respect for history and vision for growth. Our project management services are designed to bring expertise, collaboration, and care to your legacy Endeavours.

Our Approach:

Bespoke Tailored Strategies for Unique Legacies:

We recognize that every legacy project Carrie’s its own history, significance, and aspirations. Our team crafts projects management strategies that respect the past while meeting the demands of the present and future.

Seamless Collaboration and Execution:

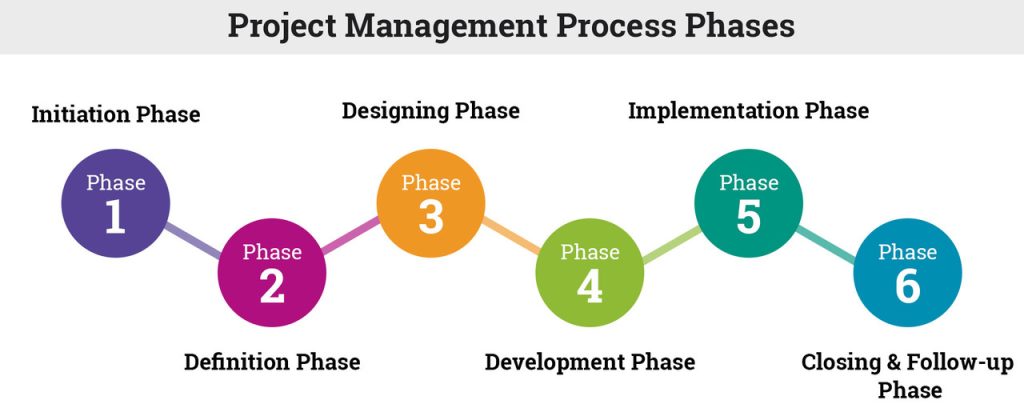

Our experienced and trusted global family office network, along with your designated project management team, will orchestrate every phase of your legacy project from planning to competition, ensuring that each detail aligns with the project’s. Legacy and future sustainability.

Quality and Integrity:

Preserving the authenticity of a legacy project requires the alignment of talent, treasure, and time. We help bring together the best team from our global family office network to empower your legacy project.

With our legacy project management expertise, let’s collaborate today to ensure that your legacy project becomes a reality and endures for generations.

Lugen Family Office, and our bespoke global family office network, is currently focused on inspirational legacy projects in the following areas:

- Commodities

- Real Estate

- Green Technology

- Artificial Intelligence

- Cryptocurrencies

- Infrastructure