Harvard Business Review March/April 2026: Key Insights

The March/April 2026 issue of Harvard Business Review confronts a single overarching question: how should organizations lead

Comprehensive Wealth Management & Investment Solutions for Institutional Investors

Tailored strategies for private equity firms, endowments, pension funds, and institutional asset managers

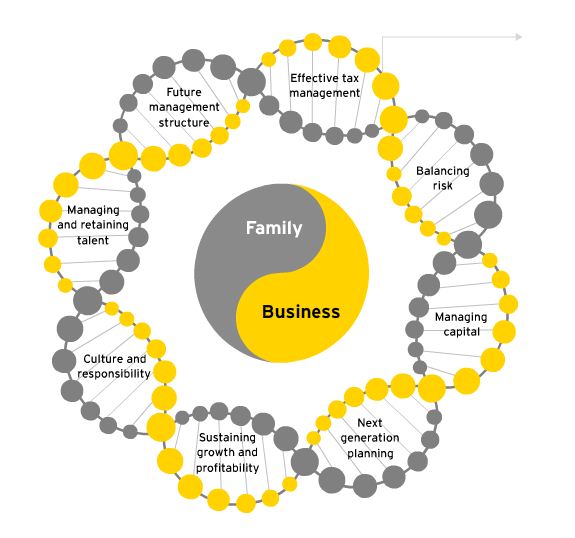

Lugen Family Office provides institutional-grade family office services designed to meet the complex needs of endowments, pension funds, private equity firms, and institutional asset managers. Our expertise in wealth structuring, risk mitigation, tax efficiency, and alternative investments ensures that institutional investors can preserve capital, optimize returns, and maintain regulatory compliance.

We deliver bespoke financial strategies that align with the long-term objectives of institutional investors, offering a data-driven approach to wealth management, investment diversification, and governance.

Our Institutional Focus Includes:

We provide fully customized family office services designed to help institutional investors manage risk, enhance financial efficiency, and maximize long-term asset performance.

We’re part of your team. We’re in your corner. Our clients trust us because we are committed to transparency, accountability, creative strategies, and total disclosure.

Institutional investors require a higher level of financial structuring, risk management, and investment sophistication. Lugen Family Office delivers tailored family office services that align with the specific needs of pension funds, endowments, private equity firms, and institutional asset managers.

We provide specialized investment solutions designed for large-scale asset portfolios.

Gain exclusive entry to private markets, hedge funds, and infrastructure investments.

We implement sophisticated financial models and scenario planning to manage volatility.

Our team ensuresfull compliance with international financial regulations.

Speak with our family office experts to explore how we can enhance your institutional investment strategy, minimize risk, and improve financial efficiency.

Unlock your legacy project with our tailored financing strategies that combine creativity, strategic planning, pragmatic insights, and expertise to address your unique needs. At Lugen Family Office, we specialize in designing innovative and customized financing strategies that empower individuals, businesses, and governments to achieve their vision. Our flexible approach ensures every solution is aligned with your vision and values to foster sustainable growth and long term success. Discover the power of innovative financing that empowers your legacy projects.

Dreams do come true but only if you follow through with the implementation of the proper steps to manifest them. Unfortunately, medici Family Office has witnessed too many successful family businesses who have great buy sell agreements, estate plans, etc. in their possession, often created by leading professionals, but which documents were never executed or updated. At Medici Family Office, we like to remind our clients that money spent without proper execution is only money wasted. The road of good intentions only leads to failed desires.

The role of a Family Business Consigliere is to counsel business owners, and their families, through guidance, support, accountability and encouragement in creating an inspirational life story.

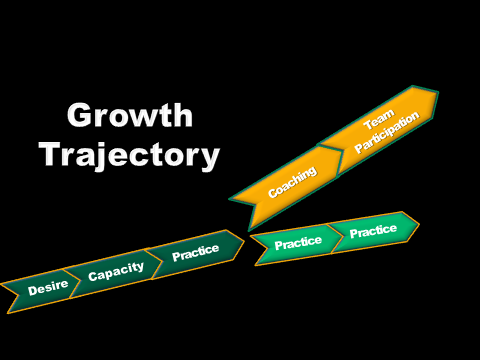

Meeting your desired outcomes is really determined by three elements: desire, capacity, and practice. Daryle Doden, CEO of Ambassador Enterprises, explains these core elements as follows:

The role of a Family Business Consigliere is to counsel business owners, and their families, through guidance, support, accountability and encouragement in creating an inspirational life story.

While you were in that four-year span, you probably didn’t notice much change; from your perspective it was gradual and seamless. But if you could see the two versions of yourself standing side by side – and especially if you could talk to them both – the growth would be readily apparent.

Desire is present when you recognize a need or are attracted to a benefit. You can desire a spouse, a car, a promotion, a skill, and so on. If that desire is strong enough, you have sufficient motivation to step out of your comfort zone and accept the risk of failure.

Capacity is your potential to receive and apply the knowledge needed to fulfill a desire. Having enough personal capacity does not mean you will actually apply anything; it just means you have the potential; you are not disqualified by an insurmountable limitation.

Practice is the application that transforms a desire from theory into reality. In its earliest stages, practice is simply action – forcing your capacity to do something with your desire. Early stages of practice are often discouragingly clumsy, but they graduate from indiscriminate action to more refined action as experience introduces additional knowledge. Practice gives way to better practice, and that yields growth in any endeavor.

Michael Jordan on Practice

At Medici Family Office, we believe that changing your thoughts will change your beliefs which will change your habits. Therefore, your decisions about why, what, when, who, and how you practice on a daily basis have a significant impact on your trajectory for growth. To simplify, Daryle Doden looks at the main choices you can adopt to alter your trajectory.

“One strategy is to grow through more individual practice (depicted in the lighter green arrows). Growth continues but levels off slightly for two reasons. First, you are likely to see diminishing returns from simply repeating the same action, especially when restricted by your own perspective; you don’t know what you don’t know, and you can’t see what you can’t see.

Second, like most of us, you will tend to deal with that diminishing return by lowering your commitment to practice. Concluding that you’re reaching the limits of your capacity to improve, you may prematurely settle for an unnecessary ceiling. The gold arrows illustrate an alternate strategy that involves other people in the ongoing practice. Although this adds some complication, it also ignites additional engines.

A coach asks powerful questions and provides valuable external feedback. This usually includes encouragement (affirmation of what you’re doing right), exposure of blind spots (education on what you’re doing wrong), and co-creation of supporting structures, including accountability.”

Your private family business consigliere will collaborate with you to elevate your trajectory so that you can have a healthier, more fulfilling, and increased productive life. Although the ultimate trajectory is your choice, your Consigliere, along with a strategic and collaborative team, will keep you accountable to your passion, values, and purpose in life. Remember, it’s difficult to get a truly objective answer from yourself about your business, or even certain aspects of your life, but your Consigliere will always tell you the truth, even if you don’t want to hear it.

Using our innovative Seven Generation Legacy Process, Business Families can now enhance trust, improve communication, gain clarity on important leadership issues, and train the the next generation with their own private and confidential Consigliere. Effective and efficient succession planning, business transition planning, business exit planning, business financing, business expansion, mergers and acquisitions, and leadership coaching are now within your reach through Medici Family Office.

Medici Family Office also works with leading psychological, behavioral, and sociological experts to assist our clients better understand themselves and the people around them. After a comprehensive psychometric, behavioral, and cultural assessment, Medici Family Office helps family businesses align their true desires with their core values.

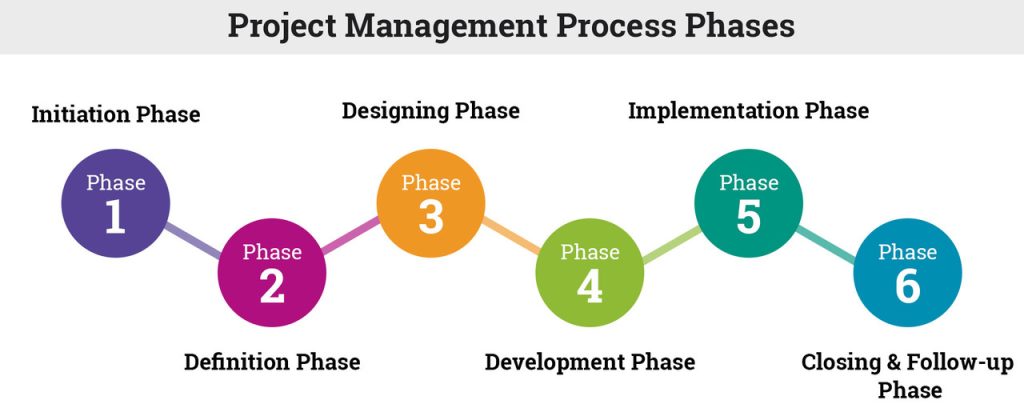

Most of the legacy projects that we select at Lugen want to integrate our family office into the project with some agreed upon ownership. In these arrangements, we typically waive our above project management fees, other than any agreed upon setup, administration, and travel and accommodations expenses, and we take on the ownership success risk with our partners. In these types of Joint Venture agreements, we will agree upon a success fee for our family office at the end of the implementation of the legacy project plus our ownership percentage upfront.

The March/April 2026 issue of Harvard Business Review confronts a single overarching question: how should organizations lead

The China Factor and Gold at US$5,000: A Structural Repricing of Risk

The February 9th Weekly

Markets at an Inflection Point: Rotation, Policy Boundaries, and Volatility in a Late-Cycle Environment

Family office services for institutions include investment management, tax structuring, risk mitigation, and governance solutions tailored for pension funds, endowments, and private investment firms.

We use data-driven financial modeling, risk diversification strategies, and hedging techniques to protect institutional portfolios from market volatility and regulatory risks.

Institutional investors gain exclusive access to private equity, hedge funds, infrastructure projects, and real asset investments, structured for long-term capital appreciation.

We implement tax-efficient strategies that minimize liabilities, enhance post-tax returns, and ensure full regulatory compliance for institutional investors.

Our process begins with an in-depth consultation to understand your financial objectives, risk profile, and investment strategy. Contact us today to discuss your institutional wealth management needs.